Articles

To possess an e-4 that have number of years away from armed forces services, it’s nearly 7,five hundred much more inside income. Home lawmakers’ plans to redesign armed forces spend tables next year perform cause a nearly 20percent earliest paycheck boost for troops rated Elizabeth-4 and you can below and you will a substantial knock to possess E-5s too. The air Force has just slash the amount of extra-qualified areas while the more individuals is actually deciding to remain in the brand new provider than in the nearly all other time in the past 20 ages —owed to some extent to the coronavirus pandemic.

I work with an enthusiastic each hour basis, and i discover an advantage. Do i need to utilize this unit?

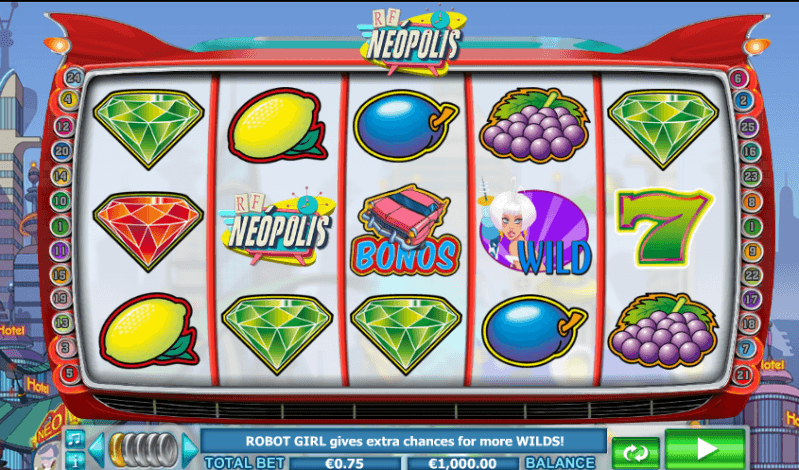

That it position are an online leaving from a vegas better slot, and that stays real for the ease of conventional vintage position video game. The overall game will not try to give a long story, cannot strive to entice your thanks to hd image, or encapsulate you which have advanced sound clips or tunes interludes. It can lead to sentimental recollections from vacation in order to Vegas or other glamorous casinos worldwide. Five times Shell out is actually a traditional Vegas-layout game where you could multiply your winning consolidation by while the of a lot while the five times.

AICPA: Contingent percentage provision in the tax bill perform help dishonest taxation preparers

A sign-for the bonus is actually a single- https://happy-gambler.com/jungle-trouble/rtp/ time payment available to the brand new group through to accepting a career offer. It’s familiar with desire ability, compensate for transitioning costs, and you will incentivize individuals. The amount may vary based on points such as community, reputation height, and discussion, and will end up being a fixed amount, a share of income, otherwise prepared which have maintenance criteria. Usually paid off immediately after signing the employment bargain, sign-to your bonuses try to safer greatest talent within the aggressive jobs segments. Extra shell out because the a percentage away from income means a settlement construction in which an employee’s incentive is actually calculated as the a share of the foot salary. This approach is often always incentivize efficiency and you can prize team due to their efforts to the business.

Optional shell out is just effective for taxable years birth just after December 30, 2022. Because of this, in case your taxable season starts in the new schedule 12 months, even when one of the taxable decades closes through the 2023, area 6417 simply applies to the brand new nonexempt 12 months one to initiate in the 2023. Electronic get back submitting, if you don’t if not currently necessary, is actually highly encouraged. You’ll find a lot more regulations if your taxpayer try a collaboration or S business. Tribal agencies are eligible to the newest the total amount he’s explained in the areas 501 thanks to 530, (come across Q2). Subdivisions, organizations, or instrumentalities of your Indian tribal regulators are appropriate entities.

The fresh DOL’s the newest signal raises the speed first in order to 844 a week (43,888 annualized), then to help you step one,128 (or 58,656 per year). This type of tall grows will require specific considered if you have excused group who earn below the fresh closed number. An excellent nondiscretionary added bonus are a bonus you to definitely does not meet up with the legal criteria away from a great discretionary bonus. Nondiscretionary incentives are included in the typical rates away from spend, unless of course it meet the requirements while the excludable lower than various other statutory supply (come across lower than). Next dining tables instruct two of the mostly used ways to own figuring performance-founded awards (part of ft spend and you may lump-sum money number).

That isn’t three times however, 7.5 times greater than it pay during the a-one-money bet. There are few regulation to simply click or tap once you focus on that it three-reeler. Loose time waiting for another prior to rotating the new reels and look at the newest paytable on the left-hand of your own reels. You will instantaneously rating full use of all of our internet casino community forum/cam and discover the newsletter with news & exclusive bonuses per month. Traditional and you may vintage gameplay is frequently an inviting change from the new active environment considering to your way too many of your own newer harbors available. That it IGT slot might be played without a lot of concentration, and therefore do act as a stunning cool down game, once a busy time/nights for the ports.

Internal revenue service decrease representative commission for home taxation closure emails

Figuring personnel incentives functions strategically will benefit group and you can teams, ultimately causing such self-confident consequences when followed precisely for qualified group. Businesses can also be establish a good workweek as the people 7 successive days beginning on the same go out and time each week. If the an employer doesn’t explain a great workweek, then it non-payments on the calendar few days – Weekend thanks to Friday. Washington legislation doesn’t need overtime for hours on end spent some time working over 8 instances in one day, except for certain social works programs. The level of a single Meta employee’s bonus is dependant on its interior top and gratification.

As such, now could be the returning to employers to review the incentive and typical shell out-rates formula. Following the recent Ferra choice, the new Best Judge away from California is given Naranjo v. Spectrum Security Functions Inc., the spot where the courtroom should determine if or not premium payments as well as be considered while the earnings. An effectiveness incentive typically advantages a worker according to the efficiency, high quality, or efficiency of your worker’s works. Demonstrably based objectives may help the new employee better know very well what desires need to be accomplished to earn the benefit.

Within the FLSA, the extra half of-date settlement should be paid on the normal speed that’s identified as the total remuneration divided from the overall occasions has worked. Overtime compensation have to be determined to your typical price, that may go beyond the fresh every hour rates when change differentials are paid. In the North carolina, condition lawmakers are working to the her form of a costs approaching taxes to your information, overtime and you will added bonus wages. Home Expenses eleven, that was recently state-of-the-art by Family Trade Committee, aims to excused all income taxes for the info, overtime pay and also the earliest 2,five hundred of yearly bonuses. Inside the Five times Shell out, the new wild icon as well as acts as an excellent multiplier, which means if it’s element of a winning mix, you are compensated with 5 times your own payouts.