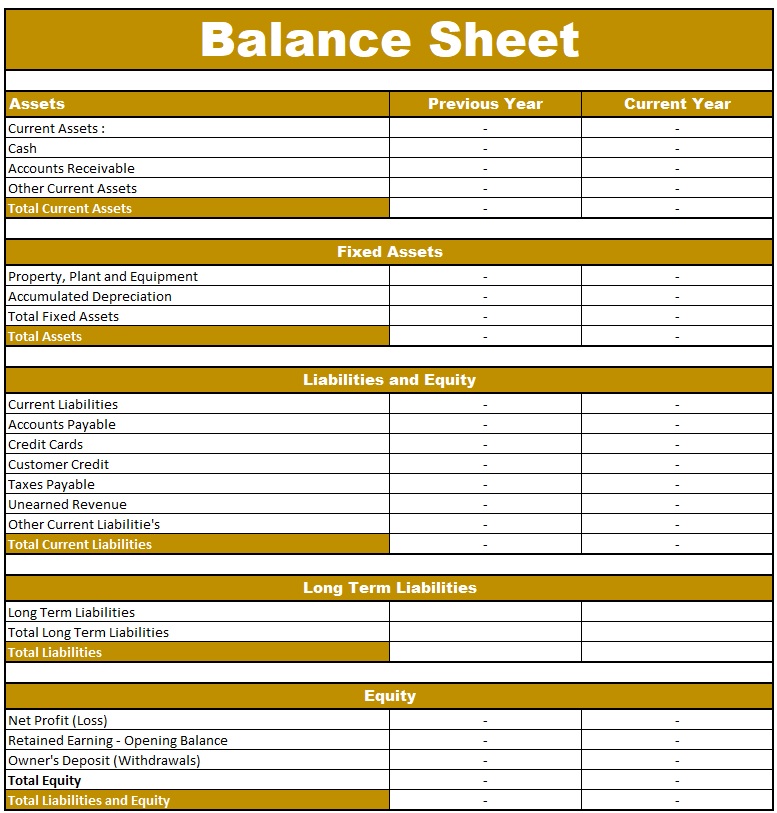

Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. Unlike the income statement, the balance sheet does not report activities over a period of time. The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day. This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day.

Submit to get your retirement-readiness report.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website.

How Balance Sheets Work

Manufacturing costs to total expenses is a financial metric that measures this proportion. A higher calculated result indicates more expenses are attributable to costs directly needed to manufacture the product. Dividing the total revenue of a manufacturing company by the number of employees generates the revenue earned per employee. An investor uses the calculation to determine the technological efficiency of an entity. First, a company has in place durable fixed assets that don’t require much ongoing maintenance. Second, a company may elect to simply replace equipment with newer, more reliable heavy machinery.

How Pair Eyewear consolidated systems, enhanced efficiency, and refocused resources with Ramp

- A company usually must provide a balance sheet to a lender in order to secure a business loan.

- An income statement, also called a profit and loss (P&L) statement, lists out a company’s revenue streams (such as sales) and expenses (payroll, operating expenses, etc.) over a given period of time.

- The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

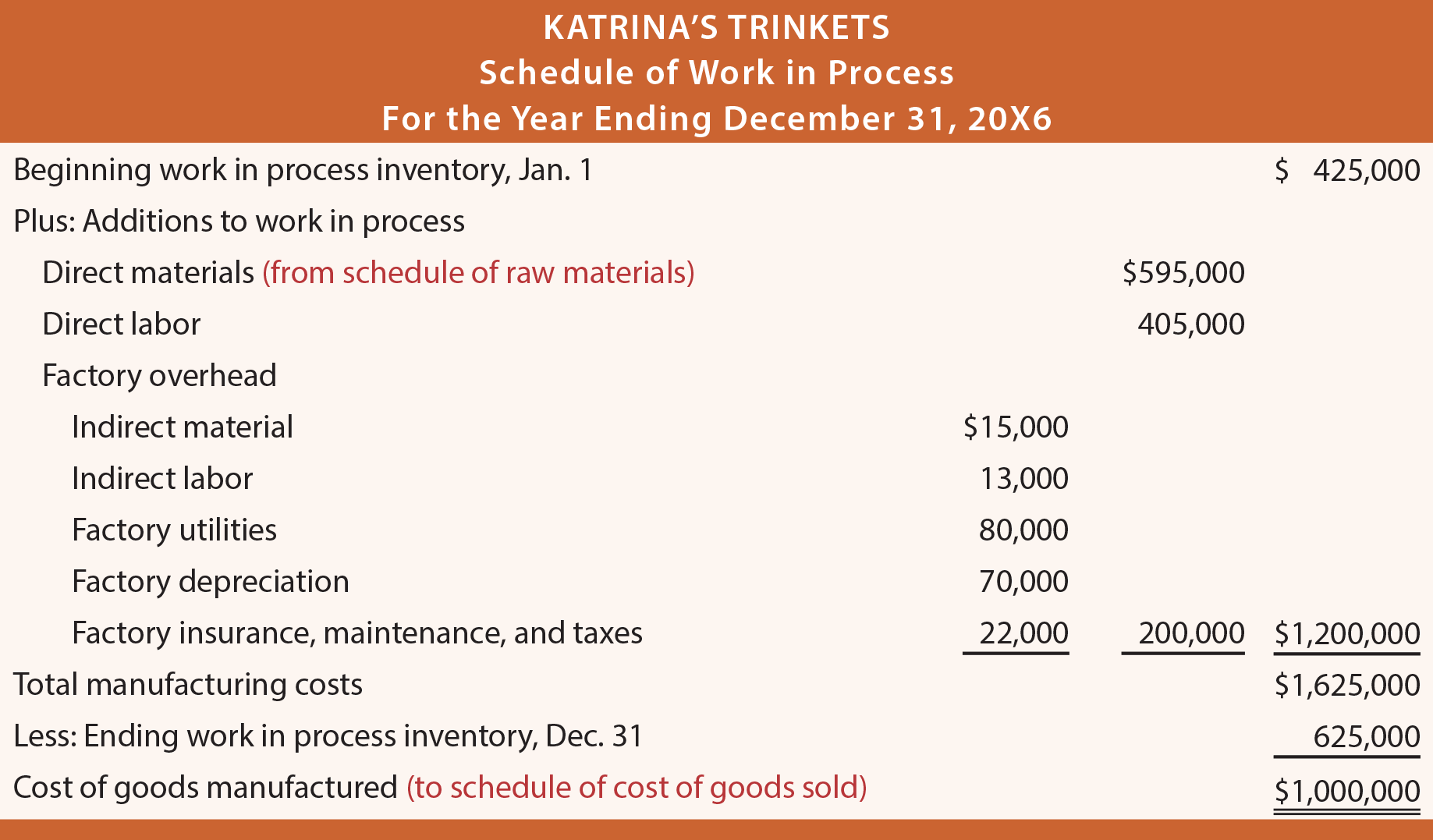

- The goal of going through the process shown in Figure 1.7 is to arrive at a cost of goods sold amount, which is presented on the income statement.

Also, the schedule of cost of goods sold is simply included in the income statement. Many companies prefer this approach because it means they do not have to prepare a separate schedule. The balance sheet, income statement, and cash flow statement make up the three main financial statements that businesses use.

Step 2: List all of your assets

Additionally, manufacturing financial insights help businesses maintain compliance with local regulations while ensuring timely reporting. Both situations can misrepresent the company’s financial performance, complicating the assessment of its health and growth prospects. To avoid these issues, manufacturers should adhere to strict revenue recognition guidelines. Manufacturing financial statements are crucial for both internal and external stakeholders, as they underpin key management and investment decisions.

This practice ensures that the values of raw materials, work-in-progress, and finished goods are accurately reflected in financial reports, which is crucial for informed decision-making. However, accurate financial reporting not only highlights taxable income on your 2021 irs tax return due in 2022 areas of success but also identifies necessary adjustments, guiding manufacturers toward optimized performance. Moreover, precise financial statements empower manufacturers to adapt their strategies in response to fluctuating market conditions.

At the same time, crediting the profit and loss account by the amount of manufacturing profit does not affect the net profit. This inventory fraud was a relatively small part of the fraud allegedly committed by Rite Aid executives. In fact, Rite Aid’s net income was restated downward by $1,600,000,000 in 2002. The former chief executive, Martin Grass, was sentenced to eight years in prison and the former chief financial officer, Franklyn Bergonzi, was sentenced to 28 months in prison.

This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio.

However, inaccuracies in these statements can lead to severe consequences, including flawed budgeting, mispriced inventory, and misguided operational strategies. To mitigate these risks, it is essential to understand and avoid common mistakes in financial reporting. By leveraging accurate insights into financial performance, manufacturers can make informed decisions based on detailed performance data.

To an investor, this metric is important, as the company with 20 employees is better financially leveraged in the long term. For that reason, we continuously develop products that can streamline business processes in all industrial sectors, no matter how big. To better understand its impact, let’s explore how Old Chang Kee, a renowned food manufacturer, used an integrated ERP system to enhance accuracy, streamline operations, and optimize performance. This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable.